By: seeker of truth

Global trade tensions have reached a fever pitch in 2025 as the United States under President Donald Trump doubles down on sweeping tariffs against trading partners. A new wave of U.S. import taxes – described by the administration as “reciprocal” tariffs meant to pressure other nations – is reverberating through the world economy. These actions have sparked swift retaliation from China, strained relations with allies in Europe and Canada, and prompted frenetic adjustments by countries like India and Vietnam. This article examines the major themes emerging from a flurry of recent communications and reports on tariffs and trade: the U.S. tariff strategy and its rationale, the geopolitical responses across multiple countries, the economic consequences unfolding globally, and the spectrum of public opinion surrounding this escalating trade war.

Background

Tariffs have long been a tool in Trump’s “America First” trade policy. During his first term (2017–2021), he initiated a trade war with China and imposed duties on steel, aluminum, and other imports, arguing that past trade deals and foreign practices hurt American industry. A partial truce came with the 2020 Phase One deal with China, but many tariffs remained in place. Now in 2025, with Trump back in office, the tariff battles have not only reignited but expanded. The administration’s core grievance is large U.S. trade deficits – the U.S. buys far more from certain countries than it sells – which Trump views as evidence of unfairness. In early April 2025, he launched an aggressive tariff campaign aimed at leveling those imbalances. The President raised tariffs sharply on imports from China and other nations with big surpluses, and even introduced a baseline 10% tariff on all countries. Major U.S. trading partners were put on notice: reduce the trade gap or face punitive fees at the border.

This dramatic move set the stage for a worldwide scramble. Historically, such unilateral U.S. tariffs are unusual in scale; they hark back to protectionist eras. Trading partners have been quick to protest through diplomatic channels and at the World Trade Organization. Nevertheless, the U.S. administration insists the tariffs will protect American jobs, revive domestic manufacturing, and pressure others to lower their barriers. As one trade supporter framed it, other nations “have either had higher tariffs on U.S. [goods] or kept U.S. out of their markets. It’s time for free and fair trade”, echoing Trump’s justification. With this backdrop, the world is witnessing a cascade of reactions and consequences in real time.

U.S. Tariff Strategy

The Trump administration’s tariff strategy in 2025 is sweeping in scope and unapologetically hardline. At its core is a push for “reciprocity” – imposing tariffs on foreign goods at levels comparable to those countries’ own import barriers or trade surpluses with the U.S. In practice, this has meant blanket tariffs on virtually all imports, with extra penalties for specific nations. For example, a 10% base tariff now applies to all goods entering the U.S., with higher rates calibrated to bilateral trade gaps. Countries that run large surpluses with the United States have been hit with especially steep duties. China, which sends hundreds of billions of dollars more in goods to the U.S. than it buys, is facing tariffs reportedly as high as 145% on its exports. Other nations have also been targeted: India, for instance, was initially slated for a 26% tariff on its goods after the U.S. cited India’s ~$45 billion trade surplus. Even close neighbors Canada and Mexico, despite the existing USMCA trade agreement, have seen renewed tariff threats this year – a continuation of Trump’s past tactic of leveraging duties during NAFTA negotiations.

The White House claims these measures are necessary to push trading partners into fairer deals. Trump has offered short-term reprieves as bargaining chips. In early April, he announced a 90-day pause on most tariff hikes for major partners (excluding China) to allow negotiations. U.S. officials signal that if allies buy more American products or cut their own tariffs, the U.S. might suspend the duties. This carrot-and-stick approach is pressuring capitals worldwide to come to the table. “Countries are scrambling to find ways to lower their U.S. tariff burdens, including buying more U.S. oil and gas,” Reuters reported, as nations seek to alleviate Trump’s sweeping import duties. Pakistan, for example, faces a 29% U.S. tariff due to its surplus and is now considering importing U.S. crude oil for the first time to offset the imbalance. Similarly, India moved quickly to negotiate: within days of the tariff announcement, New Delhi finalized terms for the first phase of a trade deal, aiming for a “win-win” outcome within 90 days. U.S. Vice President J.D. Vance is expected to visit India as part of these talks.

Domestically, the administration portrays the tariffs as a long-overdue correction to decades of trade abuses. Trump frequently cites examples like Canada’s dairy tariffs, which he has characterized as shockingly high – “they charge our farmers 270%”, he lamented, referring to Canadian import taxes on dairy. Fact-checkers note this claim is misleading: while Canada does have tariffs in the 200%+ range for dairy, those only apply above certain quotas. Under normal trade volumes (and under USMCA, the updated North American trade pact), most U.S. dairy exports to Canada enter tariff-free. Moreover, Canada’s overall trade relationship with the U.S. is far from one-sided – U.S. government data showed a U.S. goods trade deficit with Canada of around $35–63 billion in 2024, nowhere near the $200 billion figure sometimes suggested in political rhetoric. By highlighting such examples, Trump nonetheless bolsters a narrative that other countries have taken advantage of the U.S., and that his tough tariffs will ultimately force concessions that benefit American workers. The U.S. strategy, then, is a high-stakes gambit: inflict short-term pain (even on U.S. consumers and companies) to restructure global trade in America’s favor.

China’s Retaliation

No country has been more central in this clash than China. Beijing has responded to the U.S. tariffs with an equally forceful counteroffensive, combining its own tariffs on American products with export restrictions that strike at the heart of global supply chains. China’s government has effectively weaponized its dominance in critical raw materials – notably rare earth elements – to hit back at Washington. In mid-April, China suspended exports of a wide range of crucial minerals and high-tech magnets, a move threatening to choke off supplies vital to automakers, semiconductor firms, and defense contractors worldwide. Shipments of rare-earth magnets – essential components in everything from electric vehicles and drones to missiles – have been halted at Chinese ports as authorities draft a new export control regime. Once in place, these controls could outright block certain Western companies (particularly U.S. military suppliers) from obtaining China’s rare earth materials. It’s a powerful lever: China produces about 90% of the world’s rare earth magnets and a majority of other rare earths, giving it a near-monopoly in materials foundational to modern industry. Beijing’s message is clear – if the U.S. raises tariffs, China can withhold the raw materials that U.S. and allied industries need.

Chinese officials frame this as a defensive measure provoked by Washington. The export crackdown was described by state media as retaliation for Trump’s “sharp increase in tariffs” that started on April 2. In addition to rare earth curbs, China has targeted high-profile American exports. It has effectively halted imports of U.S. beef, a market worth roughly $2.5 billion annually, by refusing to renew import licenses for over 300 American meat processors and slapping new tariffs on U.S. beef. As a result, U.S. beef shipments to China – which had been the third-largest export destination for American ranchers – have ground to a complete stop. This has opened the door for other suppliers like Australia to surge into the Chinese market, with Australian beef exports to China jumping by an estimated 40% to fill the gap.

Beijing’s retaliation extends into aviation and manufacturing as well. In a dramatic step, China instructed its airlines to suspend all new deliveries of Boeing passenger jets and to stop purchasing U.S.-made aircraft parts, effectively freezing a major stream of American high-tech exports. “China has barred its country’s airlines from accepting deliveries from Boeing in retaliation against Donald Trump’s tariffs,” one report noted, with Boeing caught in the middle of the clash and losing access to one of its biggest markets. This news sent shockwaves through financial markets – Boeing’s stock slid as much as 4.5% in pre-market trading on the reports. Chinese authorities have also reportedly told carriers to avoid buying aircraft components from U.S. suppliers. Given that China is one of the largest customers for Boeing (and aviation demand in general), this retaliation strikes directly at a marquee U.S. manufacturer and its workers.

Meanwhile, China has imposed its own steep tariffs on many U.S. goods. In some categories, the tariffs are eye-popping – for instance, duties on American beef, pork, and agricultural goods have soared into the triple digits (100%+), effectively pricing U.S. products out of the Chinese market. Beijing is clearly aiming to exert maximum pressure on politically sensitive U.S. export sectors such as farming and aerospace. Chinese state media and officials have also been on the offensive rhetorically. They accuse the U.S. of bullying and have warned that China will not back down. In one symbolic flourish, President Xi Jinping’s visit to Vietnam in mid-April was accompanied by language opposing “unilateral bullying” and a rallying call for regional solidarity against protectionism. Indeed, China has been shoring up alliances: during Xi’s Hanoi visit, China and Vietnam signed 45 cooperation agreements on everything from supply chains to technology and agriculture. The timing was no coincidence – both socialist-led nations are being squeezed by U.S. tariffs (Vietnam, too, faces threatened U.S. tariffs of 46% on its exports). Xi’s message was that neighbors should help each other mitigate the pressure and build an economic order less dominated by Washington. One observer noted that Trump’s tariffs are inadvertently providing an opening for a new international economic order to emerge – one not centered on the United States.

In summary, China’s response has been firm and multifaceted. By curbing exports of indispensable materials (like rare earths) and cutting purchases of high-value U.S. goods (like Boeing jets and farm products), Beijing is leveraging its role in global trade to inflict pain on the U.S. economy. Both sides have thus escalated the conflict to a level where the stakes are enormous, raising questions about how far each will go and what a protracted standoff could mean for the world.

Global Responses

Beyond China, a host of other countries have been drawn into the tariff confrontation – each responding in their own way to the U.S. trade offensive. Allies in Europe and North America, as well as emerging economies in Asia, have scrambled to calibrate their policies, with reactions ranging from negotiation and compromise to retaliatory threats and new strategic partnerships.

Europe: The European Union has been walking a tightrope, trying to avoid an all-out trade war with the U.S. while defending its economic interests. The EU was alarmed to find itself in Trump’s crosshairs again – especially the industrial powerhouse Germany, which runs a sizable trade surplus with America (largely via auto exports). Early signals suggested the U.S. was considering tariffs in the 20% range on European goods, including automobiles, if no new deal is reached. European officials have thus rushed to dialogue. European Commission President Ursula von der Leyen reportedly struck a conciliatory tone, “hitting pause on $21 billion in planned tariffs ’til July” in hope of negotiating a settlement. EU diplomats have even floated the idea of a **“zero-for-zero” arrangement – essentially eliminating all transatlantic tariffs – which, tellingly, was a concept Trump himself proposed back in 2018 but was rebuffed at the time. Now, however, Washington appears reluctant; one commentator noted that Brussels’ overture for mutual tariff elimination is on the table, “but Trump won’t bite. This ain’t over.”. Meanwhile, Europe is bracing for economic fallout. UBS economists have slashed forecasts for Eurozone growth, now projecting only about 0.5% growth in 2025 (and 0.8% in 2026) if the U.S. tariff barrage continues, with export-driven economies like Germany hit the hardest. The head of auto giant Stellantis, John Elkann, warned that U.S. and European policy choices are “putting the auto industry at risk”, pointing to tariffs (along with strict new emissions rules) as a double threat to carmakers. Europe has also been considering counter-tariffs of its own in case talks fail. However, for now the EU’s response has been chiefly diplomatic – delaying any retaliation while lobbying U.S. officials intensely (for example, Europe managed to spare iconic products like American bourbon whiskey from a tariff hike after heavy lobbying). Still, Europe is clearly concerned that a prolonged tariff fight could tip its fragile economy into recession, and EU leaders are seeking a solution that defends Europe’s interests without blowing up the alliance.

Canada and Mexico: America’s neighbors, Canada and Mexico, already renegotiated terms with Trump once in the form of the USMCA trade agreement, but they have not been entirely shielded from the new tariff salvos. In fact, in February 2025, the U.S. briefly rattled Canada and Mexico with tariff threats, which prompted concessions, only for Washington to come back with additional demands later. Canadian officials have publicly struggled to understand why they weren’t granted the same 90-day tariff pause that some others received, leading to political finger-pointing in Ottawa. (Canada’s Conservative opposition lambasted the Liberal government for “not understanding why we didn’t get the 90 day break like the rest of the world (except… China)” – a pointed domestic controversy.) On the surface, U.S.-Canada trade tensions have centered on long-standing irritants: dairy and agriculture (as noted, Trump continues to rail against Canada’s supply-managed dairy sector), digital services taxes, and Buy American provisions that harm Canadian suppliers. Canadian commentators have tried to set the record straight on some issues: for example, Trump’s oft-cited figure of a 250% Canadian dairy tariff is technically true but largely irrelevant, since in practice U.S. dairy exports remain mostly untariffed under quota and Canada actually imports a lot of American milk products. Similarly, while Trump has claimed the U.S. loses massively in trade with Canada, the actual deficit numbers are modest and include a U.S. surplus in services. Nonetheless, Canada finds itself compelled to placate Washington yet again to avoid damaging tariffs. Ottawa has hinted at increasing defense spending and cooperation (for instance, in Arctic security) to appease U.S. demands, and like others, it is exploring buying more American goods. Mexico, for its part, has thus far maintained a lower profile in this round, likely because its trade surplus with the U.S. (mainly via autos and manufacturing) puts it at high risk. Mexican officials are quietly pursuing assurances that USMCA’s stability won’t be upended. Both Canada and Mexico know from experience in 2018–2019 that Trump is willing to use tariffs as leverage even against close allies – steel and aluminum tariffs were only lifted after tough negotiations. Now, facing the prospect of auto tariffs or other measures, these countries are trying a mix of quiet compliance (e.g. adjusting policies to meet U.S. requests) and multilateral pressure in concert with Europe and others.

Other Asia-Pacific Economies: Across Asia, U.S. trade partners are recalibrating relationships and, in some cases, finding opportunity amid the turmoil. Vietnam has emerged as both a beneficiary and a target in the U.S.-China trade rift. On one hand, Vietnam has enjoyed growth as companies diversify supply chains away from China – even a U.S. senator quipped that Vietnam became the “back door” for China to circumvent tariffs by routing goods through its factories. On the other hand, Vietnam’s own booming exports to the U.S. ($100+ billion annually) led the Trump administration to threaten it with a hefty 46% tariff if no adjustment is made. Caught in the middle, Hanoi opted for diplomacy: it entered talks with Washington to reduce the tariff threat, while simultaneously strengthening ties with Beijing as noted earlier. The 45 cooperation deals signed during Xi Jinping’s visit signal that Vietnam and China are closing ranks on supply chain cooperation, technology, and even joint patrols. Vietnam’s leaders have to balance not alienating the U.S. (Vietnam wants continued access to the U.S. market and is negotiating new trade terms) with not relying solely on the U.S. in case the door slams shut.

India, another major Asian economy with a trade surplus vis-à-vis the U.S., has taken a proactive conciliatory approach. When confronted with Trump’s tariff plans (India was originally singled out for a ~26% tariff on its exports), New Delhi swiftly engaged in high-level talks. In February, India and the U.S. agreed to work on a phased trade deal and by April had “finalized the terms of reference” for the first phase of an accord. Indian officials are optimistic a “win-win” deal could take shape within 90 days to avert the tariffs. As part of this, India signaled it would address U.S. concerns: sources indicate India is considering slashing tariffs on over half of the goods it imports from the U.S. and significantly increasing purchases of American products. The goal is to roughly double bilateral trade to $500 billion by 2030 in a more balanced way. Additionally, India has taken steps to ensure it is not used as a transshipment hub to smuggle Chinese goods into the U.S. tariff-free – the Indian government announced tighter customs scrutiny to prevent any rerouting of goods that would undermine U.S. trade rules. This indicates India’s eagerness to stay on Trump’s good side and possibly turn the situation into an opportunity (for example, by attracting manufacturing investment from companies moving out of China).

Elsewhere in Asia, U.S. allies like Japan, South Korea, and Taiwan are also adapting. Japan and Korea, big exporters with whom the U.S. has smaller deficits, reportedly escaped immediate tariffs due to the 90-day pause. But they are not sitting idle. Notably, some are investing in U.S. energy projects to ease trade tensions. In one case, an Indian state-run company and a consortium of Japanese, Korean, and Taiwanese firms discussed taking stakes in American LNG (liquefied natural gas) projects to import more U.S. gas. This would reduce their trade surpluses while securing energy supply – a strategic two-bird-one-stone solution. At the same time, companies in these countries are rethinking production plans: a telling example is Nissan’s decision to cut production of its Rogue SUV in Japan (destined for the U.S. market) over the spring, becoming the latest automaker to alter manufacturing plans in response to the new U.S. import tariffs. This suggests Japanese automakers may shift more production to their U.S. plants to avoid tariffs, similar to what Detroit sought in the original trade war.

In sum, the global response has been a mixture of accommodation and retaliation. Many U.S. partners are trying to negotiate or make trade concessions (increasing imports of U.S. goods, signing new deals) to dodge the tariff bullet. Some, particularly U.S. allies, are emphasizing common ground and mutual benefit in hopes the U.S. will exempt them. At the same time, alternative alliances are forming. China is deepening ties with neighbors; ASEAN nations are talking about boosting internal trade to reduce reliance on Western markets. The geopolitical chessboard is shifting: countries like Russia (though not a focus of this article) are no doubt eyeing chances to partner with China or others if U.S. trade ties fray. Europe is cautiously exploring closer economic links with Asia as a hedge. The ultimate trajectory of these responses will depend on whether the U.S. stays the course on tariffs or strikes deals in the coming months.

Economic Consequences

The escalation of tariffs and trade barriers in 2025 is rippling through the global economy with significant consequences. Early indicators point to slower growth, higher prices for consumers, and disrupted industries – even raising the specter of a possible recession if the standoff persists. In the United States, while a recession is not yet a reality, forecasters have grown increasingly concerned. Some economists estimate the probability of a U.S. recession in the next year at anywhere from 40% to as high as 80%, citing trade policies like tariffs and rising inflation as key drivers of risk. The U.S. economy has already shown signs of cooling: consumer confidence has dipped and unemployment ticked up to around 4.1%. The Federal Reserve, which had been battling high inflation through interest rate hikes, now faces an added complication – tariffs that act like a tax on consumption, potentially fueling price increases even as they dampen growth.

American consumers and businesses are indeed starting to feel the pinch of higher import costs. Tariffs are essentially taxes on imported goods, and while some companies may initially absorb part of the cost, eventually those costs tend to be passed through to buyers. Analysts point out that tariffs are applied at the port of entry – meaning import prices jump – even if retail prices don’t immediately reflect the change. Over time, stockpiles of pre-tariff inventory run out and consumers could see noticeable price hikes on imported electronics, clothing, and other goods. One trader observed that the talk of a new import tax on tech products had markets worried about higher prices, though many were taking a “wait and see” approach. Still, evidence of impact is emerging. For example, the video game and board game industry has reported “higher prices, fewer games, delays, and uncertainty” as a result of tariffs on China-made products, which are central to that sector’s supply chain. Similarly, a U.S. audio equipment entrepreneur who manufactures in China lamented that with tariffs, ultimately “you pay the tariffs. Not the Chinese. Not the government. You,” underscoring that American importers and consumers shoulder the burden.

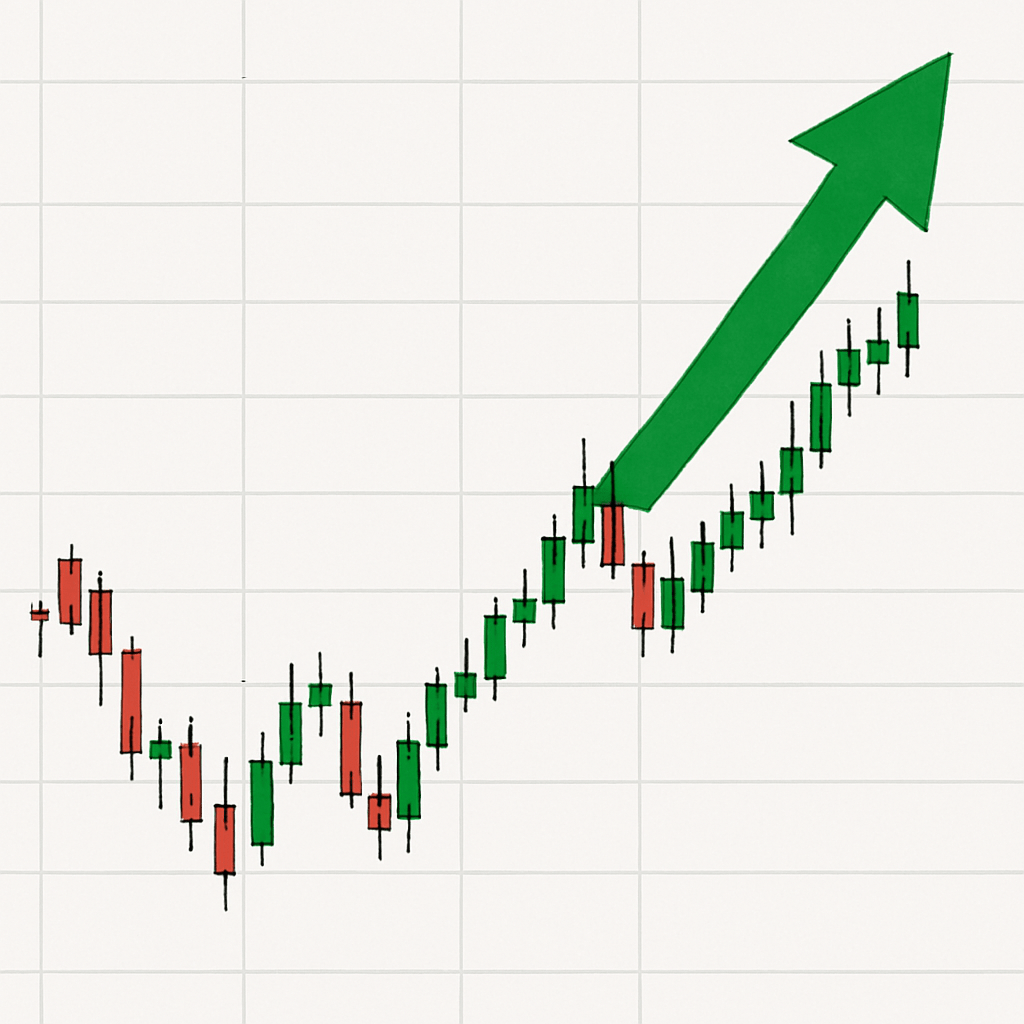

Financial markets have been volatile in response to trade headlines. The Dow Jones and S&P 500 have swung on news of tariff moves or potential trade talks. Certain stocks and commodities serve as barometers of trade sentiment. For instance, gold prices have climbed amidst the uncertainty – “Markets hate uncertainty. Gold feeds on it,” as one market watcher put it. Gold, seen as a safe haven, often rises when investors sense trouble in international commerce and politics. Conversely, equities tied to global trade have stumbled. Shares of major multinational companies – especially those reliant on China – have taken hits. Boeing’s stock drop of 4-5% on China’s aviation retaliation is one vivid example; similarly, U.S. agribusiness firms and meat producers have watched their valuations waver as export prospects dim. An analysis from Bloomberg noted that tech giants also were not immune: Apple’s market capitalization was down substantially (hundreds of billions in lost value at one point), and Amazon had lost significant value in the span of a week, amid fears that tit-for-tat tariffs and slowed global growth would hurt big tech revenues. These swings highlight how investor confidence can erode when a trade war intensifies.

Globally, economic growth is expected to downshift. We already noted Europe’s growth forecasts have been cut sharply for 2025. In China, the toll of the conflict is likewise becoming apparent. Current data show China’s GDP growth forecast for 2025 has been revised down to about 3.4%, a marked decline from prior years. Such a slowdown in the world’s second-largest economy has implications everywhere – from commodity exporters that supply China to luxury brands and universities that count on Chinese demand. China’s government is likely to roll out stimulus measures (as it has hinted) to counteract tariff impacts, but whether that can fully offset the drag is uncertain. Other emerging markets, too, face collateral damage. Countries deeply integrated into global supply chains (South Korea, Taiwan, Malaysia, etc.) suffer when trade flows seize up. The World Trade Organization has warned global trade volumes could contract if the tariff escalation continues unchecked, and the International Monetary Fund has signaled that the trade war is a top risk to the world economy’s outlook.

Specific industries are navigating major disruptions:

- Manufacturing & Supply Chains: Companies that rely on cross-border supply chains are hastily restructuring. Multinational firms have been relocating production to avoid tariffs, a trend that actually began in the 2018-19 trade war and has accelerated now. For example, Nike moved much of its shoe manufacturing from China to Vietnam around 2019 when Trump first imposed tariffs on China, and that shift proved prescient as China is now an even higher-cost location due to tariffs. Other apparel and electronics makers have followed suit, expanding operations in Vietnam, India, Mexico, or even bringing some assembly back to the U.S. Likewise, automakers are tweaking their production footprints: Honda is reportedly considering shifting more of its car production from Canada and Mexico into the United States, aiming to have 90% of the cars it sells in the U.S. made domestically to mitigate new auto tariffs. And as mentioned, Nissan is cutting output in Japan for U.S.-bound models – likely to increase reliance on its U.S. factories. This reconfiguration of supply chains is costly and time-consuming, but companies view it as necessary insurance if tariffs become a long-term reality.

- Agriculture: American farmers are once again in the crosshairs of retaliation. China’s halt of U.S. beef imports is one blow; additionally, China has maintained steep tariffs on U.S. soybeans, pork, and other farm goods (a continuation of retaliation from the earlier trade war). U.S. agricultural exports to China have plummeted as a result. Farmers, who in previous years received federal aid to offset lost exports, are now expressing deep anxiety about losing vital markets permanently. Meanwhile, competing producers in Brazil, Australia, and Europe are eagerly taking up the slack in China and elsewhere, potentially eroding U.S. market share for the long run. American beef producers, for example, worry that once Chinese buyers solidify supply relationships with Australia or South America, it will be hard to regain that business even if tariffs are removed. This dynamic is true across many commodities.

- Technology and Industry: The tech sector faces both export hurdles and import cost increases. China’s new export controls on rare earth elements and high-tech magnets pose a serious risk to industries like consumer electronics, renewable energy, and defense manufacturing outside China. The U.S. defense industry in particular is sounding alarms. An advisor to the Pentagon on critical minerals explained that if China fully bans rare earth magnet exports, it “potentially [has] severe effects in the U.S.,” given how essential these components are for drones, precision-guided weapons, and advanced electronics. James Litinsky, CEO of the sole U.S. rare earth mine (MP Materials in California), said that with Chinese supplies suddenly shut off, “the critical inputs for our future supply chain are shut down”, referring to defense contractors who need these materials. The U.S. simply does not have short-term substitutes ready; rebuilding rare earth supply chains (mining and refining capacity) domestically or with allies will take years. This supply shock is an unintended consequence of the trade war that could spur higher costs and production delays in high-tech sectors. Moreover, American tech firms from Apple on down are nervously watching for any direct Chinese action against them (beyond tariffs), such as consumer boycotts or regulatory hurdles in China, which could hit their earnings. Thus far, China’s retaliation has stayed in the realm of trade and not targeted individual U.S. companies in China, but the risk remains.

- Energy: An interesting side effect of Trump’s tariff policy is a boost in U.S. energy exports. Since many countries are trying to appease the U.S. by buying more American products, U.S. crude oil and LNG exports are seeing increased interest. As noted, Pakistan and India are exploring first-ever imports of U.S. oil and gas, and East Asian nations are investing in U.S. energy projects. This could in the short term benefit the U.S. energy sector, potentially narrowing the U.S. trade deficit on the margin (energy trade was an area where the U.S. has moved into surplus). However, these adjustments also highlight how distorted trade flows are becoming due to tariffs – not necessarily following market efficiency, but rather political pressure.

Overall, the economic consequences of the tariff conflict are complex. Some U.S. industries protected by tariffs (e.g. steel or textiles) may see temporary relief from import competition, and indeed steel prices in the U.S. have risen which helps domestic mills. But the net effect, according to most economists, skews negative when trading partners retaliate broadly. Higher input costs, retaliatory export losses, and uncertainty all weigh on growth. Even Trump’s former economic adviser Gary Cohn famously quipped that “tariffs are taxes” that harm economic growth. We are now seeing that play out: multiple analysts warn that if the U.S.-China trade freeze persists and broad tariffs remain for more than a few months, the cumulative drag could be enough to tip the U.S. or global economy into a downturn. On the flip side, if negotiations in the coming weeks yield deals – for instance, if Europe and others strike agreements to eliminate certain tariffs, or if China and the U.S. return to talks – much of this damage could be mitigated. Businesses worldwide are anxiously hoping for resolution, but preparing for the worst.

Public Opinion

Public opinion on the tariff showdown is sharply divided, both within the United States and among the international community. In the U.S., reactions largely fall along partisan and sectoral lines. Among Trump’s political base, there is strong support for the tough trade stance – a belief that short-term pain will yield long-term gain as other countries capitulate. Many of the President’s supporters express unwavering confidence. “I’m not concerned. I have full faith in our president. We support him 100%,” said one supporter when asked about the tariffs. Others credit Trump for finally confronting China: “His masterful plan – [he] played China like a fiddle. Maybe [it’ll be] rough for the next few weeks, but…” (implying they expect a favorable outcome). This mirrors sentiments often heard at Trump’s rallies or on talk radio, where tariffs are framed as a necessary battle to rebalance trade and revive American industry. Indeed, some U.S. manufacturers and labor groups have backed the tariffs in principle, arguing that decades of offshoring and unfair competition must be addressed, even if it means higher costs. A strain of nationalist economic thought, rejuvenated in recent years, sees the tariff conflict as a chance to bring factories back to American soil – as one slogan puts it: “Don’t forget to bring jobs back to America”.

However, public opinion is far from unanimous. Many consumers, farmers, and business owners – as well as most economists – have serious reservations. Critics of the tariffs point out that they function as a tax on Americans and risk undoing economic progress. A common refrain among opponents is that Trump is fixated on tariffs as a blunt tool and “doesn’t have a plan” for the fallout. Some Republican lawmakers from farm states have quietly expressed alarm over lost export markets for agriculture. Democrats largely oppose the tariff escalation, arguing it will hurt working families through higher prices. Progressive Senator Bernie Sanders, for instance, while critical of China’s labor practices, has also warned that tariffs can be a self-defeating policy if they raise costs on consumers (though Sanders has nuanced views on specific trade issues). Public opinion polls (where available) suggest that while a majority of Americans agree China’s trade practices are problematic, they are split on whether sweeping tariffs are the right remedy.

Notably, American farmers and ranchers – a key constituency – have grown increasingly anxious. Organizations like the Farm Bureau have called for an end to the trade war, emphasizing that farms have been “collateral damage.” Likewise, retailers and industry trade groups (from the Consumer Technology Association to the Footwear Distributors of America) have lobbied against broad tariffs, cautioning about price hikes and job losses in retail. An economic commentator on X (Twitter) summarized the concern: “Tariffs will definitely cost US jobs when combined with budget cuts… Cut spending and tariffs kill jobs,” referring to the double-whammy of fiscal tightening and trade barriers reducing economic activity. That view is backed by many experts who predict net job losses if the tariffs remain in place – for instance, manufacturing may gain some jobs, but agriculture and services could lose as exports fall, and higher input costs could lead to layoffs in downstream industries.

There’s also a philosophical divide: free trade proponents see the tariff war as harmful to the global trading system the U.S. helped build, whereas economic nationalists see it as a corrective. This debate has spilled into public discourse. Media outlets and think tanks have hosted myriad debates on the issue. One side often cites the example that tariffs on Chinese goods are ultimately paid by American importers and consumers, not by China’s government, undercutting the notion that tariffs are making China pay. The other side retorts that short-term cost increases are a price worth paying to achieve strategic independence and stop funding a geopolitical rival. Intellectual property theft by China is frequently brought up by tariff proponents as a justification – they argue that tariffs are a tool to pressure China into stopping IP theft worth $220–$600 billion a year (a figure often cited for U.S. losses to Chinese IP theft). This resonates with the public’s sense of fairness: even some free trade skeptics concede that “it’s not just about tariffs… it’s about how China steals U.S. intellectual property”, and thus something must be done, though they might differ on the method.

On the international front, public opinion in allied countries tends to be critical of the U.S. approach. European publics generally support multilateral trade and view Trump’s tariffs as aggressive. In Europe, businesses are pressuring their governments to stand up to Trump, but also to avoid a trade war that could damage the fragile post-pandemic recovery. In China, nationalism has surged in response to U.S. pressure – Chinese social media often features comments about resisting U.S. “bullying,” and the government’s propaganda organs emphasize self-reliance and the idea that China will endure hardship and prevail. Chinese state media has highlighted how American consumers are “suffering” from higher costs, in an effort to turn U.S. public sentiment against the tariffs. Meanwhile, some emerging countries are watching with a bit of schadenfreude – for instance, segments of the public in countries like Brazil or Australia, which are picking up some of the export slack, might feel they are “winning” as the U.S. and China fight.

Overall, the public opinion landscape is polarized. In the U.S., Trump’s tariff gamble will be judged not just by economic metrics but by voters in the 2026 midterms and beyond. If the strategy yields a clear diplomatic win (say, new trade deals or concessions from China) without severe economic pain, it could vindicate his approach to a segment of the electorate. If it backfires with a recession or continued farm bankruptcies, the backlash could be significant. As one user on social media wryly noted, “So Trump can put all those tariffs on China but China is not allowed to do anything. Trump is NOT the president of the world.” – highlighting skepticism about the administration’s expectations and strategy. Another commentator quipped about the whiplash in policy rationales, noting how one day the rhetoric is about bringing back jobs with tariffs, and the next day it’s about having free trade with no tariffs, leading to confusion. This kind of public cynicism suggests that beyond the fervent base and engaged critics, a portion of Americans are simply weary of the trade war drama and uncertain about its goals.

In short, public opinion encapsulates a broad spectrum: from patriotic support and patience on one end, to frustration and fear on the other. As the impacts of the trade policies become more tangible in everyday life, those opinions are subject to change. The administration is keenly aware of this, which is why it has been emphasizing any positive news (like companies announcing U.S. factory investments or slight trade deficit reductions) in its public messaging. The coming months will be telling as to whether public sentiment shifts in favor or against the tariff strategy, as results (or lack thereof) materialize.

Conclusion

The tariff-fueled trade conflict of 2025 represents one of the most significant disruptions to the global trading system in recent memory. What began as a U.S. effort to force concessions on trade imbalances has evolved into a complex saga of economic brinkmanship. Major themes have emerged: the United States is leveraging tariffs at an unprecedented scale in pursuit of “fair trade” and reduced deficits; China has retaliated in kind, wielding both tit-for-tat tariffs and its dominance in critical exports like rare earths to strike back; U.S. allies and other nations have been caught in the crossfire, responding with a mix of negotiation and realignment of their trade relationships; and all of this is taking a tangible economic toll, raising uncertainty across markets and industries.

It is increasingly apparent that there are no easy winners in a trade war of this magnitude. As China’s President Xi Jinping reportedly told officials, “Protectionism and unilateral bullying lead to a dead end”, signaling his view that nobody truly wins from this spiral. Economic data so far in 2025 back this up: growth forecasts are being downgraded from Beijing to Berlin, and specific sectors – whether Midwestern farms or European auto plants – are feeling pain. Even as some countries and companies try to capitalize on the dislocations (for example, Australia selling more beef to China, or Vietnam attracting manufacturing), the overarching climate is one of caution and volatility.

Where does it go from here? In the best-case scenario, the intense pressure of these tariffs will bring all parties back to the negotiating table to hammer out new arrangements. It is conceivable that the U.S. could achieve updated trade deals – perhaps an accord with the EU eliminating certain tariffs, or a bilateral deal with India opening its markets – which the administration could hail as victories. China and the U.S., for their part, might eventually resume talks if the economic damage mounts, potentially leading to a new detente (even if not a full resolution of deeper issues like technology and IP disputes). Should such deals emerge, the tariffs could be dialed back, allowing global trade to resume a more normal flow, albeit with some permanent shifts (like more diversification of supply chains away from China).

On the other hand, if each side refuses to budge, we could be entering a protracted period of deglobalization, where high tariffs and trade barriers become the “new normal.” In that scenario, the global economy would likely fragment into blocs – a U.S.-centric sphere and a China-centric sphere – with limited commerce between them. The current signs of China and other Asian nations deepening intra-Asian ties, and the U.S. rallying friendly nations to buy its exports, hint at this bifurcation. Such a decoupling would have far-reaching implications: consumers might face higher prices and fewer choices, companies might have to duplicate supply chains, and geopolitical rivalries could deepen.

For now, the situation remains in flux. The coming July deadline (when the EU’s tariff pause expires) and the end of the 90-day negotiation window that Trump granted to some partners will be key junctures. All eyes will be on metrics like the U.S.-China trade volume – which is already plunging – and on any conciliatory signals from Washington or Beijing. Diplomats are working overtime behind the scenes to prevent further escalation. One thing is certain: the stakes are enormous, and the cost of miscalculation is high. As an editorial in the Financial Times noted earlier this year, a full-blown trade war between the world’s largest economies is “a war with no winners, only varying degrees of losers.”

In conclusion, the tariff battles of 2025 have underscored both the interconnectedness and the fragility of the global trading system. Economic consequences are mounting in real time, geopolitical alliances are being tested and reconfigured, and public opinion remains split on whether this path is folly or justice. The neutrality of this analysis reflects the unpredictable reality – it is not yet clear whether the endgame will be a fairer trading order as the U.S. intends, or a self-inflicted wound to the global economy. What is clear is that businesses and nations are hastening to adapt, and that the imperative for some resolution grows by the day. The world is essentially holding its breath, hoping that cooler heads prevail so that trade can once again be a source of prosperity rather than conflict.